Dealing with the Stress of Financial Hardships During Divorce

By Deirdre Hally Shaffer, MSW, LCSW

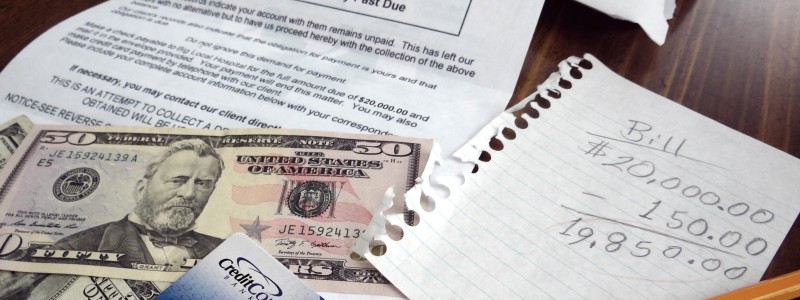

Just this week in my counseling practice, I worked with three women whose divorce resulted in extreme financial hardship. For two clients, the mortgage had not been paid in five to seven months and they are facing foreclosure. Although both women are employed, they earn less than $20,000 annually and have several children. Child support is in arrears and fear was escalating into panic. The third woman was divorcing an unemployed spouse who had no intention of working in the future or contributing toward their children’s housing, educational or any other provisional needs.

The prospect of not having money to keep a roof over the heads of your children is extremely frightening. Many people going through a divorce are not fully aware of the financial implications and grave lifestyle changes that can and will occur. The stress of worrying about money can lead to panic attacks, high blood pressure and depression. Ways to lessen the impact of this high level of anxiety begin with realistic planning for how to meet basic needs.

In my community, we are fortunate to have some resources to help those in need. The nonprofit Credit Counseling Center helps people to consolidate debt, reduce expenses and put a financial plan into place. The Bucks County Opportunity Council assists people in paying their heat and utility bills, finding and paying for housing, filing income taxes and obtaining food. We are also fortunate to have several food banks to provide needy families with basis.

To reduce the psychological and physiological impact of severe anxiety, individual counseling is helpful in providing tools to lessen stress including self-soothing exercises, meditation and cognitive awareness. The importance of identifying possibilities rather than failures is crucial in providing hope during difficult circumstances. Daily deep breathing exercises and physical activity are also helpful in slowing heart rate and improving mental well-being.

Oftentimes, when stress levels are overwhelming due to serious financial stressors like pending bankruptcy and home foreclosure, antidepressant medication is a viable and sometimes temporary option. When anxiety reaches severe levels, functioning can be compromised and physical illness can occur. The benefit of medication is in preventing further difficulties that can arise as a result of the initial stressor.

The first step is taking a practical inventory of what the financial problems are and in identifying realistic objectives. The next is garnering the support of friends, family, and organizations to assist with the journey of regaining solid footing. And when necessary, reach out to professionals who can offer counseling and medications to help you manage the situation.